Sep 18, 2018 – Lesson Learned

Premarket Insight

International markets seem to not be too worried about tariffs headlines as indices go for a nice bull run in the premarket (European hours) on strong volume, currently above the 71K mark before 08:00 ET. Will be interesting to see how this translates into the open for NQ (Nasdaq Futures) as this is about a 0.35% retracement of yesterday’s close. Technically, very possible for another day of selloff. One candle can change things quickly, as well as a tweet from our favorite Twitter handle.

Nothing significant on the calendar today.

COB Recap

Only two trades for me today getting stopped out twice. With the choppiness I decided to not take any more trades for the day and risk digging myself deeper in the hole. The market will be open tomorrow, so what I’ve learned from the past few months is not to push it when the market is not on my side. Of course, later things calmed down a bit, but it was not a super strong day. Probably could have got back in the green but price action would not have made it easy and there’s a good chance emotions would have found their way into my trading resulting in bad decisions.

I did continue with paper trading, but the result wasn’t much better with the aforementioned price action. Was completely done for the day by 10:30 ET. Another positive is I’m still green (barely) for the month which is an improvement from July and August where I got off to a decent start before giving it tall back by the second week.

For real-time insights follow me on Twitter! @Mv3Trader

Comment below with your opinions and questions.

Rob

Mv3 Trader

“Trade Consciously”

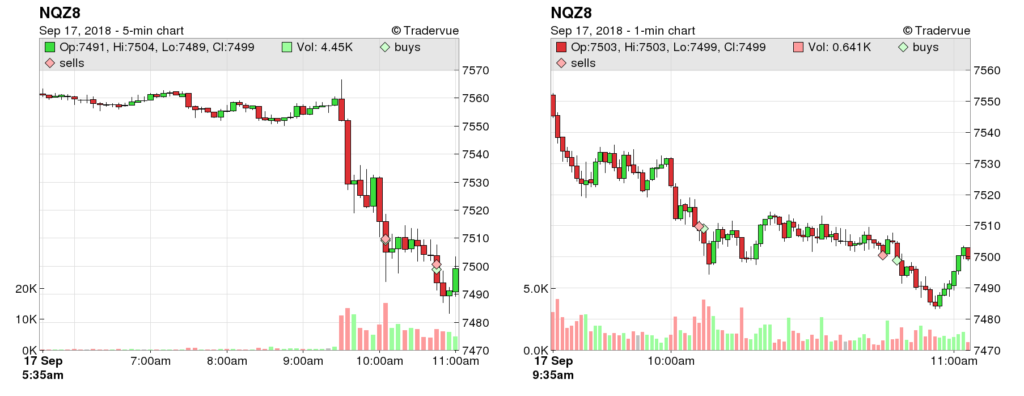

Sep 17, 2018 – Hurdles

Premarket Insight

Volume seems a bit low for a Monday as of 07:50 ET as I do my volume check. Seems to be a bit of hesitation in the markets due to continuation of “trade war” tariffs talk between the U.S. and China. At this point, NQ pretty much trading sideways with no real volatility, volume at 40k. Fingers crossed for things to pick up at the open.

Nothing significant on the calendar today.

COB Recap

Super volatile price action at the open tricked me and I missed my entry for a short trade I had setup but removed because it seemed price action was reversing. Feeling frustration from that I ended up over-managing later trades and decided to end my day early after the second scalp. Took away $50 but should have been $400 had I let those trades play out per the strategy. I seriously need to get over this hurdle of over-managing my trades.

For real-time insights follow me on Twitter! @Mv3Trader

Comment below with your opinions and questions.

Rob

Mv3 Trader

“Trade Consciously”