You’ve been trading like a pro; and you’re profitable. Now what?

As your account grows, you may be tempted to put your profits back into the market and take larger risks. Do your mental and emotional health a favor — take your money and invest back into yourself. Instead of risking your hard earned earnings on the market, build wealth by diversifying your investments.

Check out these helpful tips on how to make your money work for you. Then, download our eBook for proven strategies to scale your income through multiple revenue streams. You’ll thank yourself later.

Create a safety net

No matter how experienced you are, the market is constantly evolving and behaving in volatile ways. It’s inevitable you will make poor trading decisions from time-to-time. In addition to mitigating mistakes, the best traders protect their profits by planning ahead for unpredictable scenarios.

It can be helpful to have a fallback account in case you succumb to emotional trading habits. Put a percentage of your profits into a reserve each month. If your account blows up, you’ll have money set aside to continue your trading. Protect your gains by establishing a maximum trading account size and deposit surplus funds into your reserve.

Open a savings account to earn interest on your money. Keep in mind, most savings accounts have minimum balance requirements, low long-term interest rates and withdrawal fees. So, this may only be ideal if you plan to make limited withdrawals and allow your reserve to grow over time.

The peace of mind you’ll have knowing you have money saved will reinforce positive trading habits and ensure your continued success.

Pay yourself

Enjoy the fruits of your labor by allocating a percentage of your earnings each month to pay yourself. If you plan to pursue trading as your main source of income, consider establishing a trading LLC to offset your living expenses and maximize tax benefits.

Active traders who trade frequently enough or have an established trading business can receive tax advantages, including home-office and health insurance premium deductions. Talk to a qualified expert, like Trader Tax CPA, which specializes in trader-specific tax services.

Note: seek professional counsel before making any tax-related decisions.

Re-invest into long-term positions

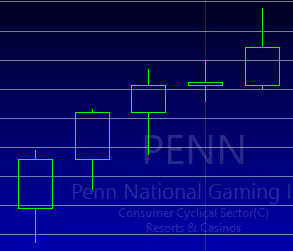

If your trading strategy is focused around short-term, momentum trading, consider reinvesting your profits into mid-term and long-term trades that require less oversight.

Dividends

Invest in stocks that pay dividends. As companies do well and earn a surplus amount of money, they take a percentage and divy it up between shareholders. The payouts may be meager, but like interest, small gains add up over time.

Swing trading

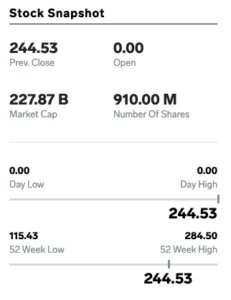

Swing and position traders typically hold positions for several days up to several years. While the profits are not as immediate as scalping or day trading, longer-term holds have the potential to accrue massive gains over time.

Options trading

Options trading is considered less risky than stocks because it allows you to predict future price moves without the obligation of buying or selling on the spot.

Retirement investments

If you’re trading while working for an employer, take advantage of your 401k by investing your surplus trading profits. Many employers will match your 401k contributions up to a certain amount.

For self-employed traders, consider opening an Individual Retirement Account (IRA). There are various kinds of 401ks and IRAs, each offering different savings and tax benefits. Do research to understand what type of retirement plan fits your lifestyle.

Invest into land or real estate

The possibilities with real estate and land investments are seemingly endless. However, these assets require active participation and development in order to generate income. Be sure to assess your bandwidth and choose an investment option that fits your lifestyle and personality.

Real estate

There are several options with real estate investments. Purchase tax liens at auction to acquire properties at heavily discounted prices; or flip homes for profit.

Property management is a viable option for those with a knack for hospitality. Once you’ve purchased or renovated a home, rent to tenants; or take advantage of online rental listings like Airbnb. Hire a property management firm to take the stress out of renting, or do it yourself.

You might also consider using your income from the market for real estate wholesaling. Connect home buyers and sellers by contracting properties and selling them for a profit. Check out this video to learn more.

Land investing

Develop the property you want by purchasing land. Choose between residential, commercial, farm, recreational land, and more. Grow crops; pave and rent a parking lot; establish a brick-and-mortar commercial building or build a new home.

Start or scale a business

Use your trading profits for startup capital or to scale a business you own. Pay for business expenses such as paid advertisements, equipment or services. Acquire products to resell via retail arbitrage or with Amazon’s FBA program which helps sellers store, package and ship their products.

Become an angel investor

Take the Warren Buffett approach and help other businesses scale by becoming an angel investor. There are a number of businesses starting up or expanding that offer equity in exchange for funding. Your investments can yield higher rates of return if they perform well. Join a website, like AngelList, that connects investors who have spare cash with startups that need capital.

Explore other revenue streams

There are tons of ways to make the most out of your money. We’ve only skimmed the surface. Get our ebook All Traders Need Multiple Income Streams for more practical ideas and hands on tips to scale your trading profits.

The Bottom line

Depending on your financial and lifestyle goals, you may benefit from reinvesting the profits you earn from trading into multiple revenue streams. Consider opening a savings account; diversifying your trading portfolio with long-term holds; purchasing land or real estate; establishing a business; or helping others scale their ideas. Most importantly, pay yourself because you deserve it! Give yourself a pat on the back and keep crushing the market.