I’m back!!!

I took a break from mv3trader.com for a while to “go into the lab” and work on some areas I desperately needed to improve. I paper traded to close out August and once I got comfortable with how I want to trade my strategy decided to return to live trading in September.

So far, I’ve been green every day with about 80% accuracy. It was 100% until I over-managed my last two trades of the day before making myself stop for the day due to not sticking to the plan. On that note, I could be doing so much better this month had I not been over-managing trades so much. I seriously need to work on that.

My P/L for the month currently sitting at +$500 but could easily be triple that had I not over-managed so many trades.

Anyway, the way ahead for this website, thinking of making some adjustments. Maybe I will do weekly journal entries instead of daily. Or I’m thinking to do a premarket insight daily that could be sent out to anyone who subscribes to the mailing list. Also, thinking of making use of the YouTube channel for the journal recaps, as well as additional content related to strategy building for all corners of the market. My schedule has become a bit busier, so I’m not sure how much time I will have to dedicate to a lot of additional content.

I would love to hear opinions on this, so please let me think by commenting below or email me at robwill@mv3trader.com. You can also DM me on Twitter (link below). Any ideas you have are welcome.

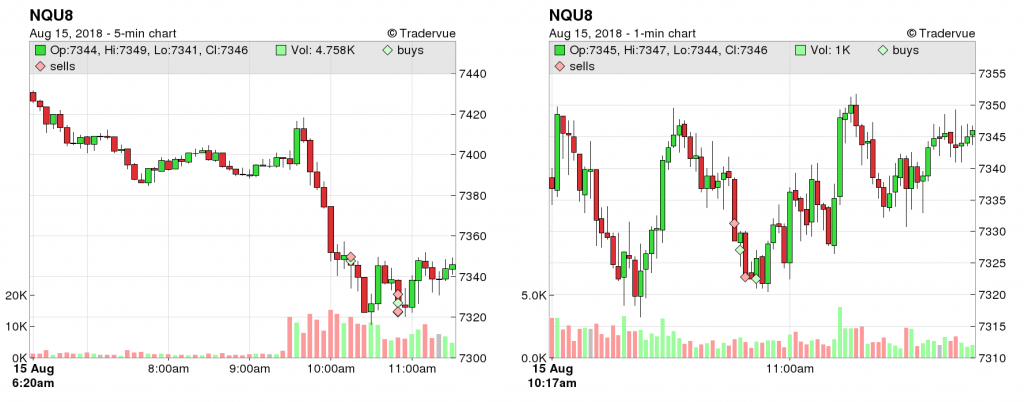

You can see my trades for this month by clicking the image below of my winner for today on NQ.

For real-time insights follow me on Twitter! @Mv3Trader

Comment below with your opinions and questions.

Rob

Mv3 Trader

“Trade Consciously”