Premarket Insight

So far, as of 07:00 ET, not much has happened in the markets on weak volume. Nothing huge stands out today, just the same trade war talks, and a couple of reports listed below on the calendar.

I will be continuing with the focus of trading consistently with patience. Now that I’ve become more willing to HTB (hit the button) and enter on my setup, need to make sure I let the trade play out as designed per my strategy.

On the calendar today, Building Permits at 08:30 ET and Crude Oil Inventories at 10:30 ET.

COB Recap

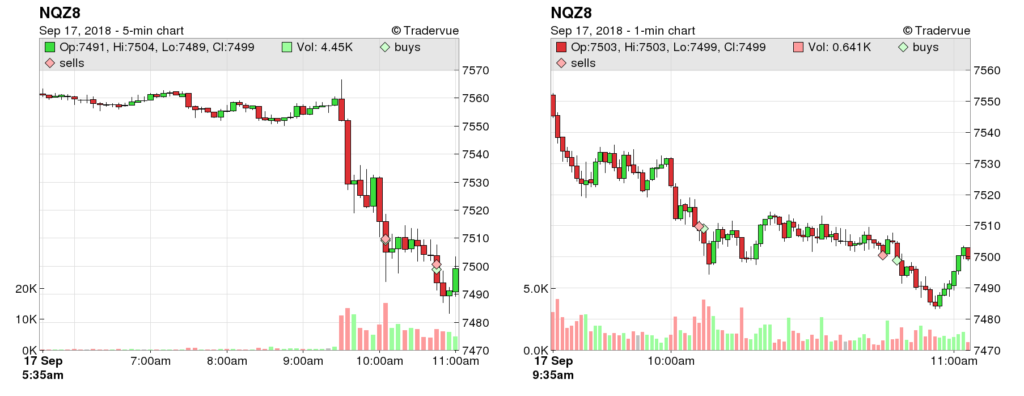

Out the gate, took a play in the 2nd minute of the open on NQ. Didn’t let it play out which would have hit target for $200, but with my exception to the not going flat rule in the first five minutes, I’m not too upset about that. Just read that play wrong.

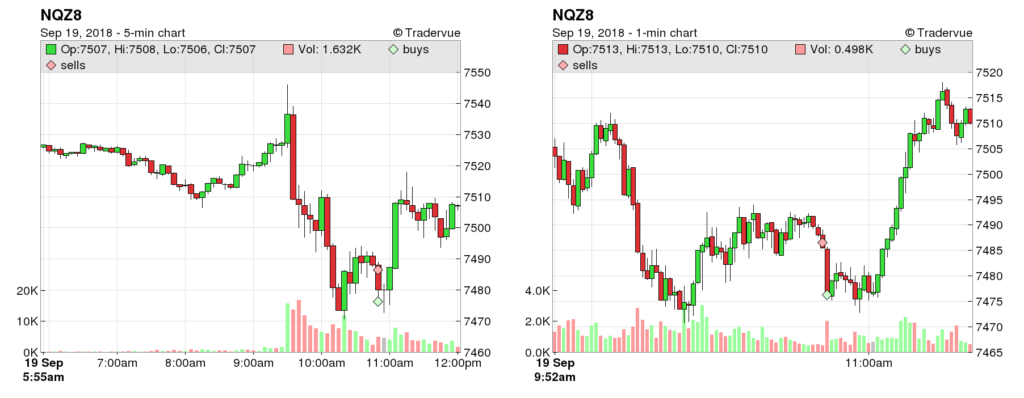

Took a while to see another setup I liked. I saw it forming but I didn’t like the timing. I wanted to enter right away, but price action wasn’t giving the signal of being ready to pop out of the small channel that was being formed. So, I struggled through the itch and feeling of FOMO and finally HTB to catch the short at the right moment for a successful play that took about 2 minutes! YES!!! Taking my wins and going home.

For real-time insights follow me on Twitter! @Mv3Trader

Comment below with your opinions and questions.

Rob

Mv3 Trader

“Trade Consciously”