Premarket Insight

Monday, Monday, Monday! CL made a strong move early in the Euro market hours moving more than 80 ticks. I’m sure based off crude oil news over the weekend.

Should be another eventful week with more trade war news, Trump tweets, and more major earnings. This week’s earnings include Google, Facebook, and Amazon which should have significant impact on the Nasdaq. (fingers crossed)

On the calendar today, Existing Home Sales at 10:00 EST.

At the Bell

Only took one play on CL getting stopped out on a potential reverse of the premarket bull run. It was a long shot but met all the requirements of my strategy so had to take it for trigger fear prevention.

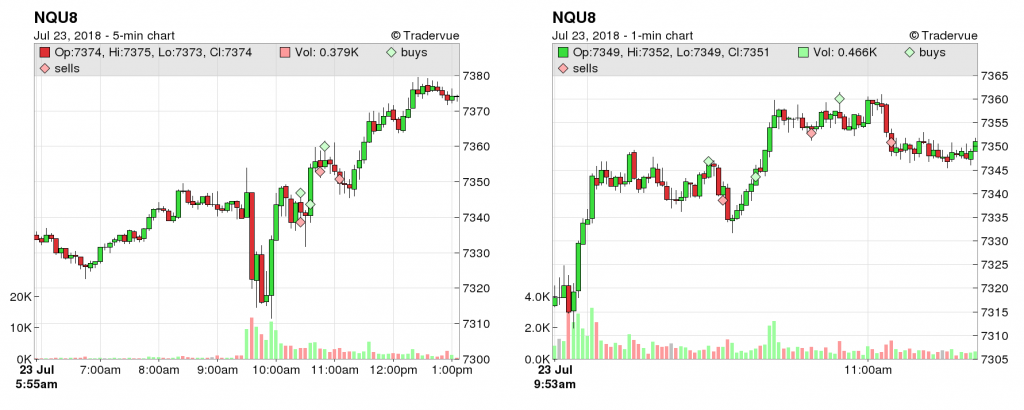

Volume looking decent but not much has happened with NQ as of yet. I missed a play on GC in the premarket but did take a successful paper trade on the continuation of that move. Good practice for the morning session of the open.

COB Recap

Calling it early again today, accepting the defeat with all the chop. Out of 6 trades only caught 2 winners, one both pretty much scalps but nowhere enough to get me off to a green start for the week. I may be down but I’m definitely not out. Good thing is I didn’t make any mistakes and had good patience. Just not the day for my strategy. Down but never out.

For real-time insights follow me on Twitter! @Mv3Trader

Comment below with your opinions and questions.

Rob

Mv3 Trader

“Trade Consciously”