Premarket Insight

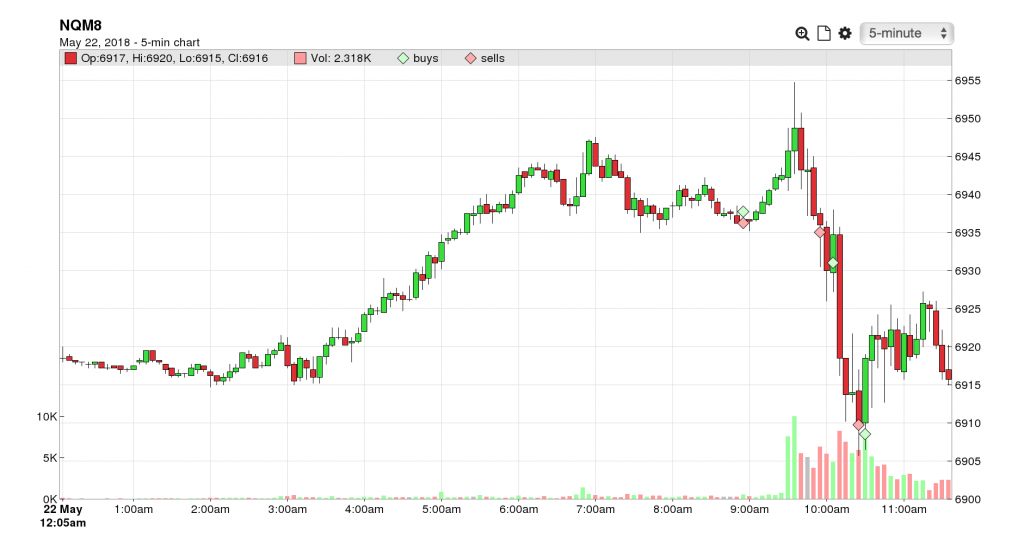

Logged into my platform to see NQ had started a really nice bull run since 3:30. At this time (6am) it’s up more than 20 points and still going. However, volume is lower than yesterday. Interested to see how this unfolds throughout the rest of the day.

Already checked the economic calendar for events happening today. Nothing highly significant to be aware of today according to investing.com.

At the Bell

So unsurprisingly, after that nice bullish move before 6am, the market pretty much died and practically traded sideways until the open bell. Only attempted on premarket trade for a small loss.

COB Recap

Bright note of the day, all this choppy lack of energy in the market is definitely helping me improve. I missed one 1R play from miss-judging price movement, which isn’t hard to do in this market, but I am getting much better with my execution. Now if only the market momentum could return to what we were seeing about a month ago. Would really love the volatility we saw back in February. #Ready

Rob

Mv3 Trader

“Trade Consciously”