Premarket Insight

What a bloody morning…

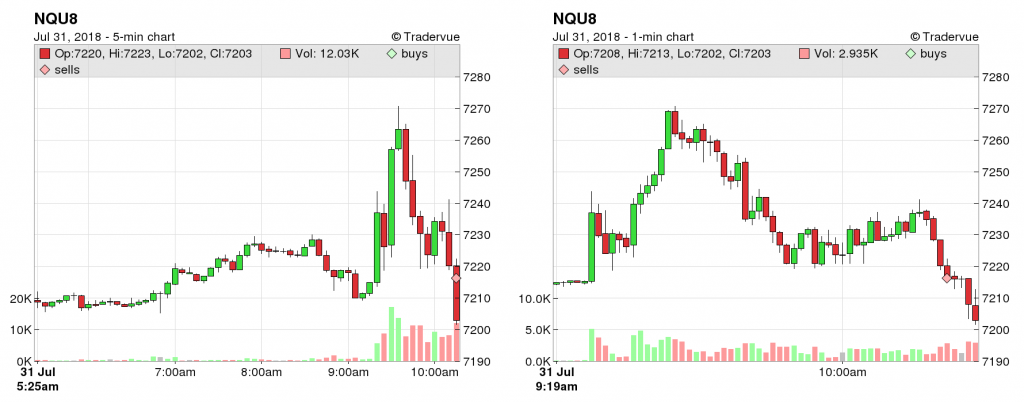

Red everywhere as I open up my charts at 07:00 EST, selloff starting in the Asian market hours. NQ down more than 50 points (-0.70%). The rest of my watchlist ES (S&P 500), CL (Crude Oil), GC (Gold), and 6E (Euro FX) all red with a lot of selloff for the non-U.S. market hours. Could turn out to be an interesting day.

According to investing.com, market selloff supposedly due to trade war between China and U.S. which makes sense as to why it started in the Asian market hours. I’m very curious to see U.S. traders’ response.

Nothing significant listed on the calendar today.

Keep in mind, none of this changes my strategy.

At the Bell

NQ jumped bullish right out the gate, making me once again wish I didn’t have the rule of not taking a trade in the first 5 minutes of the open. Have to be patient and wait for the right entry based off my strategy.

COB Recap

Well, NQ kept climbing up and never looked back and I never got an entry to take advantage. I don’t like chasing. However, I did get a nice win on CL, hitting my target for $300.

The rest of the morning for me was pretty much watching the chart like a dear in the headlights as I missed opportunity after opportunity. But I did finally unfreeze myself with a successful paper trade that I wished would have been life. Nice easy target hit for another $400.

Need to work on not getting froze after missing trades. Where’s a time machine when you need one?…

For real-time insights follow me on Twitter! @Mv3Trader

Comment below with your opinions and questions.

Rob

Mv3 Trader

“Trade Consciously”