Premarket Insight

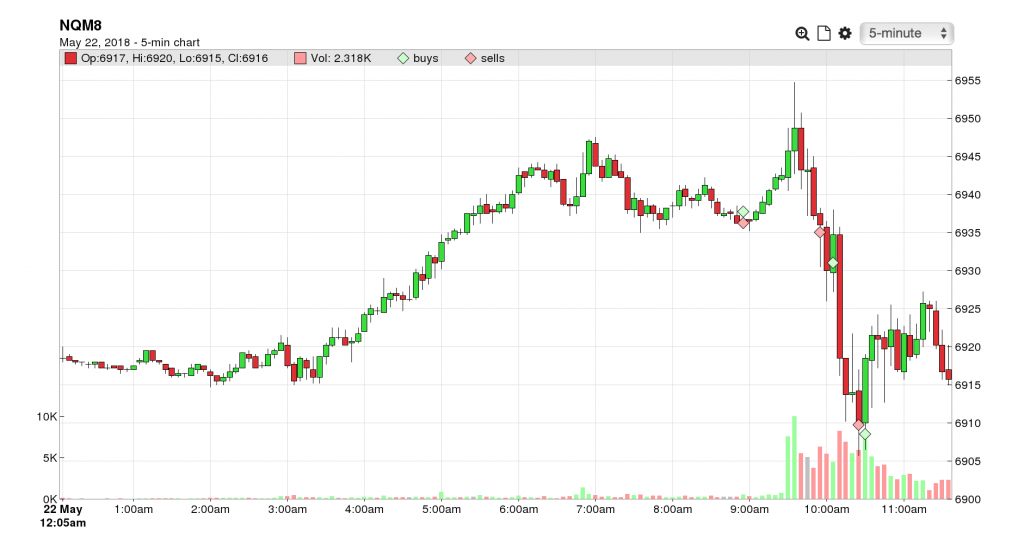

At the start of my trading time, NQ has moved bearish more than 70 points (1.03%) since yesterday’s close. Also, volume is much stronger today. This premarket bear move well below the daily support the price was bouncing off of all week.

Leading up to this time, I did a little back trading to verify I was using the correct method to play my strategy.

Economic calendar showing 3 significant events taking place today: New Home Sales @ 10:00, Crude Oil Inventories @ 10:30, and Fed news @ 14:00. Making mental notes to be aware of these time frames but will stick to playing strategy as designed.

At the Bell

A little too aggressive in the premarket taking 2 losses. Just like the last few trading days, price staying consolidated after early push before 6am. Focusing to breathe and not get frustrated. Maybe should have sat on the sidelines before the bell as I wasn’t really expecting much from the early premarket action. Was just hoping to catch a small scalp or two.

NQ shot out the gate strong bullish right at the open. Staying patient and disciplined to 10 min rule. And regret sets in as I sit and watch almost all of the bearish ground retraced within those 1st ten minutes.

COB Recap

After the big open bell pop, was able to catch some scalps on some resistance breaks and bullish bounce. Wasn’t as profitable as I could have been if I had more stop trail discipline for the bullish bounce.

A little frustration from last couple of days when I was aggressive with entry, trades didn’t work at all. But today in market hours, I’m a little more passive with entry but would have worked out better being aggressive. For example, the last play you can see in the chart below, had my entry been just a couple points sooner I would have hit my scalp target.

It is what it is I guess. To live and trade another day.

Click here for more of my plays today.

Rob

Mv3 Trader

“Trade Consciously”