Premarket Insight

Eager to get this week started from my weekend study and practice sessions, along with the improvements I made with my execution strategy. However, I am planning to move my start time back a bit to about 7 or 8 AM EST mainly due to the fact that I don’t typically get many good opportunities before this time. Of course, the best opportunities present themselves during normal market hours.

Even though this is going to be a short week it’s not short on news with the market focused on Trump’s involvement with global “trade wars” and oil agreement with Saudi Arabia. Historically, this time of the year is fairly uneventful based on seasoned traders’ sentiment, but this year may be different. (fingers crossed)

As far as the calendar, nothing significant sticks out today. Very interestingly, the markets (looking at NQ – Nasdaq Futures) started off the week early with a major selloff down more than 0.65%.

At the Bell

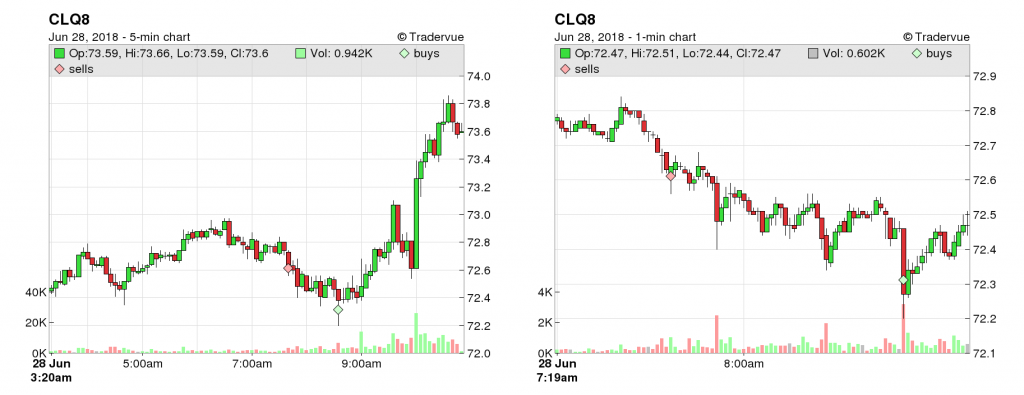

Caught a winner on CL premarket, entering the bell with my 2nd play. NQ continued to sell off in the premarket with a big dip right before the open. May end up watching NQ more today than playing, depending on what CL does.

COB Recap

Took a loss on that play on CL at the open then got way too passive with CL’s choppiness. Missed at least 3 opportunities on NQ in my live account but I did paper trade it with success. Good reason to chill on all the passiveness. Should have ended the day with $760! Good motivation for moving forward. Still, green is green so I can’t complain! #NextTime

For real-time insights follow me on Twitter! @Mv3Trader

Comment below with your opinions and questions.

Rob

Mv3 Trader

“Trade Consciously”