Premarket Insight

New month, fresh beginnings. On AAPL’s earnings report yesterday, discovered an interesting way to play the last 30 minutes of the futures market session with a catalyst. Something I will be using in the future under the right circumstances.

Speaking of catalyst, today might be a day I play the afternoon session with FOMC statement and Fed Interest Rate decision at 14:00 EST. My morning session results will determine if I play that time or not.

Other events on the calendar, ADP Nonfarm Employment Change at 08:30 EST, ISM Manufacturing PMI at 10:00 EST and Crude Oil Inventories at 10:30 EST. Should have a good start to the month.

At the Bell

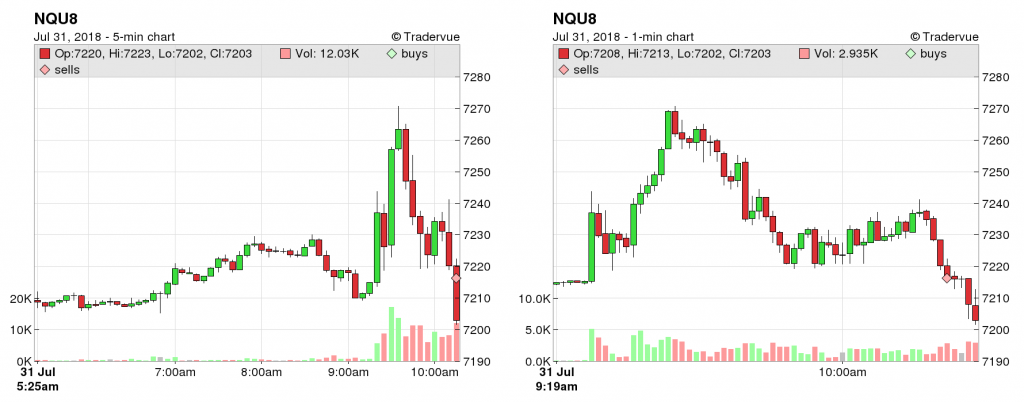

No trades premarket, officially only trading the U.S. stock market hours. So far, CL has been bearish since the open of the futures session and NQ pretty much trading sideways.

COB Recap

Not a bad start to the day and major proof of the power of my strategy in regard to how the wins makes up for the losses.

Missed a couple opportunities on NQ with it wild swings, not feeling comfortable with the entries. Those would have worked but when I finally took a trade it didn’t work out, giving back a small piece of my profits.

Overall, thanks to CL, not a bad start to the month, currently sitting at +$500 on the day. Will be taking a break here, waiting for the Fed news in 3 hours.

For real-time insights follow me on Twitter! @Mv3Trader

Comment below with your opinions and questions.

Rob

Mv3 Trader

“Trade Consciously”