Premarket Insight

Managed to make my way back into the green yesterday afternoon on the Fed news. That news resulting everything on my futures watchlist (metals, forex, and indices) taking a plunge for a close bearish.

Logging into my platform, GC decided to get going early without me, already up more than 7 points (0.55%) with volume more than 100K. The only play I could see taking today would be bearish move on some pullback action at this point.

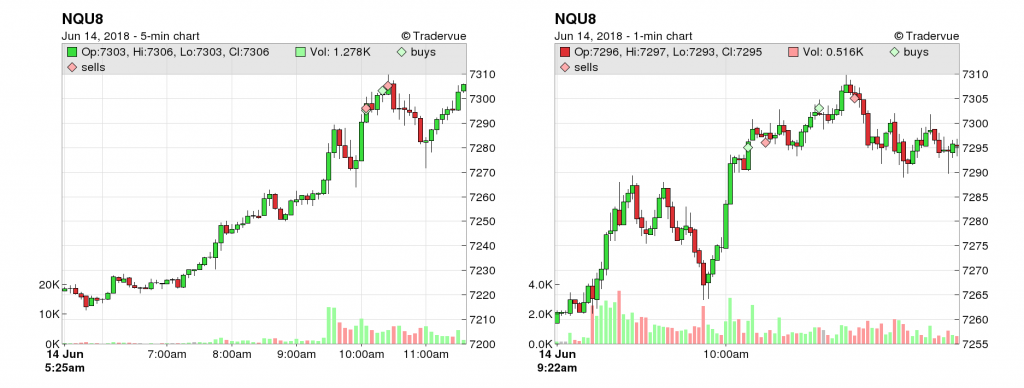

Nasdaq futures (NQ) looking pretty normal for this time. Only thing on the calendar today is Retail Sales at 08:30 EST.

I’m not currently playing forex futures, but around 07:45 EST saw the volume for 6E (Euros) going crazy and checked it out to see it dropping hard on news. Not long after, got alert on GC starting a bearish move. Entered order to go short. NQ popped bullish hard at the same time.

Fortunately, GC order was never filled, as order was placed in right location with it bouncing back bullish from my entry price before going higher. Paper traded the bullish side. Paper trade was successful in about 10 minutes. If only it is this effortless when trading live. lol

At the Bell

NQ opened up the market continuing strong bullish from its initial pop premarket. The first pullback happened about 10 minutes after the open setting up another entry long.

Price action is so volatile at this point, finding it a little challenging to find a place to get in without using a market order,

COB Recap

Was able to catch a couple scalps on a slow relatively small continuation. Still need to work on management. Had I just held it after entry the trade would have paid off more.

Ended with a green day but it should have been much more. Feeling a bit frustrated with myself.

Comment below with your opinions and questions.

Rob

Mv3 Trader

“Trade Consciously”