Premarket Insight

This weekend just enjoyed time with family and didn’t look at a chart once. I find enjoying other areas of life is a great way to clear the mind for a fresh restart after having a very disappointing day like Friday. I know my mistakes and what I need to do. I’m ready. Yesterday is not today.

This week, the U.S. – China “trade war” continues, U.S. Inflation data on Friday, and the last major wave of earnings throughout the week. Today, nothing significant listed on the calendar.

At the Bell

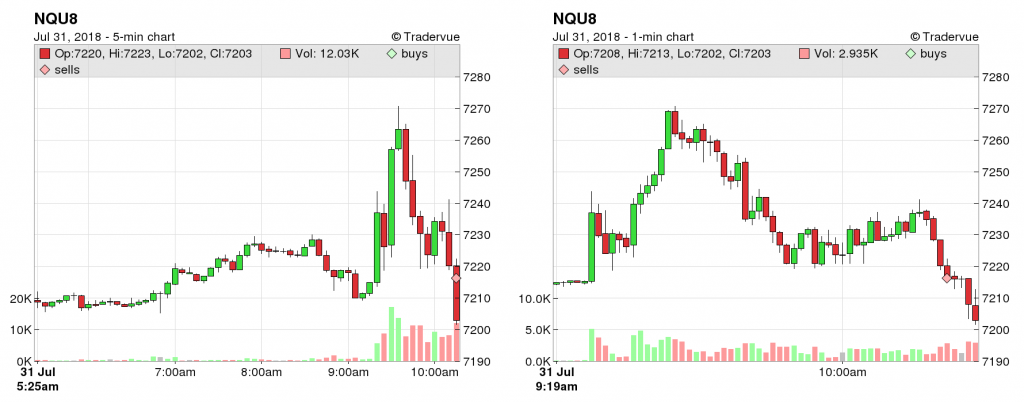

NQ’s price action was all over the place in the first 15 minutes, so no trades placed so far. Waiting for a cleaner, more rational entry based strictly off my strategy.

COB Recap

Another red day, but I’m very pleased with how it went. I stayed patient and discipline. The market was just not on my side today and it’s okay. It was actually a very relaxed day. Feels like I traded the same as I would have as if I was paper trading. Small loss and satisfying seeing my confidence growing.

For real-time insights follow me on Twitter! @Mv3Trader

Comment below with your opinions and questions.

Rob

Mv3 Trader

“Trade Consciously”