Premarket Insight

Getting to my desk somewhat late today (already 09:00 EST…). Markets climbed a bit in the Asian market hours, but pretty much flat ever since reaching that max.

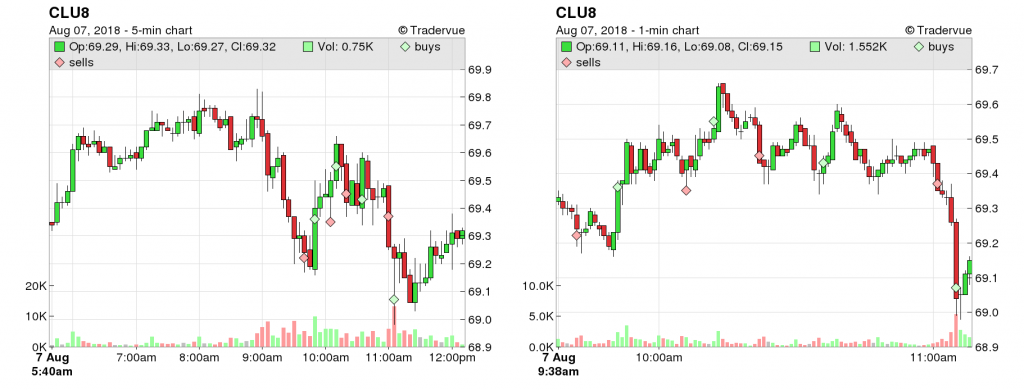

Putting CL back on the playlist today since my rule breaking debt has been paid. Lucky I didn’t miss a super huge move yesterday.

On the calendar today, JOLTs Job Openings at 10:00 EST.

At the Bell

Both NQ and CL got off to a very strong start in the first 5 minutes, of course the time I cannot trade based off my rule. But it’s still early so I’m sure there will be plenty of more opportunities to come. Have to stay relaxed and patient like yesterday.

COB Recap

Almost 100% identical to yesterday, market was super choppy and consolidation in the first two hours. Right when things started taking off in my favor got filled on an NQ play, but I guess because of the way I had the orders set up to get filled either way it went, my platform got confused and cancelled my stop for the one I got filled in. Too me a while to get myself together and manage it manually using the flatten feature to make sure I got out of the trade properly.

Then I forgot to reset my trade menu back to the strategy and ended up getting back into another trade without a stop or target. Again, manually exited that trade before deciding to at a minimum take a break so I’m not trading in my emotions. Maybe I will be done for the day since it’s almost my normal stop time but on days like these we usually see good movement during lunch or in the afternoon.

I was down a lot but those 2 scalps and finally catching a win on CL patched up my wounds a little. These last couple of days have been just horrible. I didn’t trade perfectly today but overall, I’m pleased with my performance compared to last Friday.

For real-time insights follow me on Twitter! @Mv3Trader

Comment below with your opinions and questions.

Rob

Mv3 Trader

“Trade Consciously”