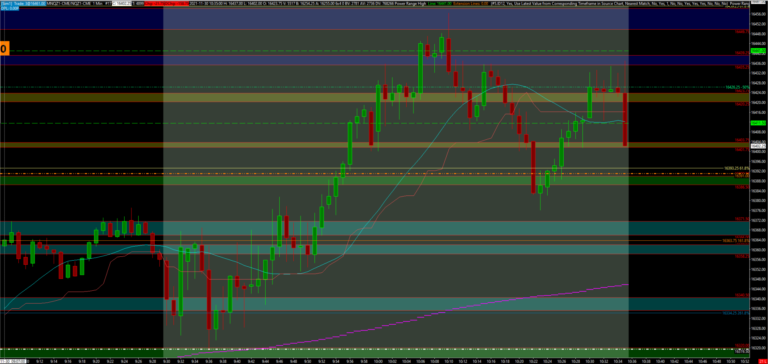

Can you spot our market maker, aka wholesale, in the screenshot above?

What is Wholesale?

Wholesale is at the core of what moves the financial markets every single day. In fact, wholesale is a key driver of all markets. This fact is important to understand because the financial markets (stocks, options, futures, forex, crypto, etc) are the same as any other market. People get together and exchange products of interest for a gain or loss.

Wholesale in the financial market is performed by market makers, facilitating the exchange of financial assets between participating buyers and sellers.

There are two terms we should be familiar with to understand the business decisions and actions of the wholesaler, inventory and supply.

A wholesaler collects inventory at “best price” depending on current market conditions with the goal to later resell that inventory for a profit.

This inventory becomes supply when the wholesaler is ready to sell the products to buyers in the market for a profit.

Learn more with live narration of how I read price action.

Simple Analogy of How Wholesale Conducts Business

To illustrate how this wholesale works in the financial markets we are going to look at through the lens of retail arbitrage.

A retail arbitrageur, or retail arbitrage seller, will look for discounted items in local stores and deals online with the goal of reselling those items for a profit.

On a larger scale, most convenience and grocery stores operate this way, but that’s another topic for another day. Retail arbitrage is typically easier to understand because anyone can do it.

Let’s walk through this illustration from the retail arbitrageur’s (wholesale) perspective. Let’s call our wholesaler for this analogy, Bob.

Bob is looking to buy several shoes, not for his own fashion, but to sell to other people interested in those shoes in his local market.

Bob goes into shoe store 1 and looks for shoes in his price range.

Bob is looking for a specific number of Air Jordans (AJ’s) since he knows his local market has a special interest in those shoes.

Store 1 only has a limited supply of AJ’s so Bob knows he will have to go to another store to find enough AJs to sell to his local market for the profit he wants to walk away with.

In addition to the AJ’s in stock at store 1, Bob also buys some Adidas and Pumas with the purpose of selling those to Store 2 which should also give him more money to fill his inventory of AJ’s. He purchases as many as he can and heads to Store 2.

On the way to store 2 however, Bob met some customers who bought some of his excess inventory. Of course he sold those for more than he paid for them at store 1.

At store 2, they have AJ’s but still not enough to fill his target inventory. Store 2 also was looking to build their inventory of Adidas and Pumas which allowed Bob to sell the rest of his excess inventory.

Bob purchases as many AJ’s as he can get from store 2 plus other brands to repeat the process on his way to store 3. Because of the sold excess inventory, Bob was actually able to purchase the AJ’s to build his inventory even more at a discounted rate.

On to store 3 and AJ repeats the same steps, selling some excess inventory along the way. And once again, thanks to his sells from the excess inventory, Bob was able to fill his target inventory from store 3 at an even bigger discount, also going beyond the inventory of AJ’s Bob was targeting.

Now Bob quickly heads back to his local market with a full inventory, plus excess, marketing all the new shoes in his inventory along the way through his social media outlets. Of course, he sold a few pairs along the way to his target market.

Once he reaches his local market, Bob is met with excited (emotional) shoe enthusiasts ready to buy the AJ’s from him, without knowing, or even caring, that Bob payed much cheaper than they are paying to buy them from Bob.

The more shoes Bob sells from his inventory, the lower his supply gets and as a result the more he charges for the remaining shoes in his supply.

Eventually, Bob satisfies the majority of his local market and shoe sells begins to slow down. So what does Bob do?

Bob starts lowering prices to unload the rest of his inventory in preparation to do market research for what shoes buyers are interested in and heads back to the stores for new inventory.

As a wholesaler, Bob repeats this cycle over and over for massive profits. His local markets loves buying the shoes Bob keeps in his inventory, giving Bob a thriving business.

Market “Research”..

There’s one other key element that we haven’t discussed yet.

How does Bob know which markets are worth his efforts and what to sell in that market?… Customer data.

Wholesale pays for data about participants in the market which they use to make trading decisions. This data is extremely valuable to the wholesaler as it let’s them know which markets and products should give them the best opportunities to make money.

In our example, this would be equivalent to the Bob paying for customer profiles from the shoe stores and online marketplaces.

This information can help Bob develop a strategy around how he purchases and sells shoes for an efficient business.

Why is the recognition of wholesale so important?

Spotting wholesale’s collection of inventory can help us have a slight edge over other participants, unaware of what is behind real-time price action. Alongside wholesale, we can enter our position at “best price” and profit with wholesale as their business is creating momentum in the market where most traders are jumping into trades with more risk.

There are several technical tools and data points that can be used to identify and analyze wholesale trade price action. This article is a highlight of the core concept.

Some of the key things I look at is structure, volume (mostly by price), and VWAP.

Highlighted on the chart below is the price structure wholesale leaves behind.