Premarket Insight

Monday has returned for a week that should be jam packed with volatile action. Of course, there’s the continuation of trade wars, but the bigger highlight is the first big week of Q2 earnings week with market moves such as Bank of American (BAC), Netflix (NFLX) and Goldman Sachs, among many others, reporting this week.

Also, the Trump-Putin Summit today, Fed news on Tuesday, and China’s Q2 GDP are additional headlines that could give the market a strong push in either direction. As always, my motto is to be ready for anything.

CL got a strong start early, already down more than 70 ticks as of 07:00 EST. Even though CL got the strong start, volume across the board is pretty light.

On the calendar today, Retail Sales and Core Retail Sales at 08:30

At the Bell

Only got a small winner off CL on a continuation play after missing the first possible play that would have been a winner in the premarket. Then, out of my mind, took a play on CL right at the open at 09:30 EST that was an immediate loser. Don’t know what I was thinking about taking a play at the bell like that.

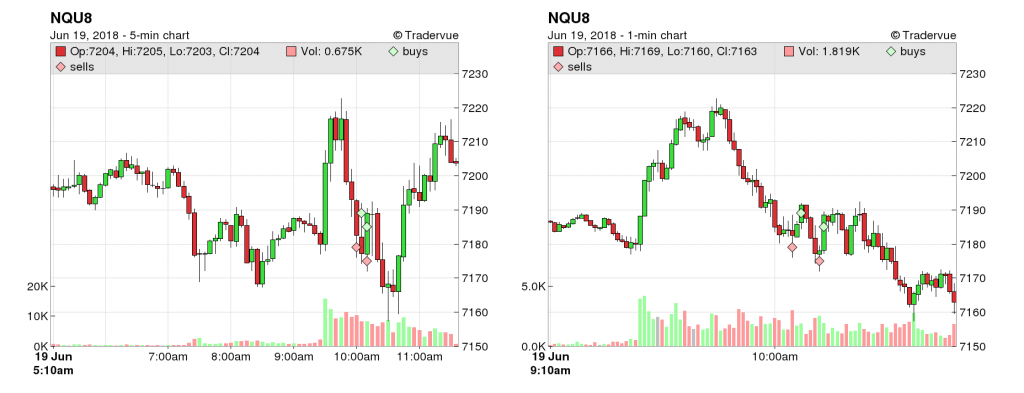

NQ mostly bouncing in the premarket and jumping long out of consolidation in the first 5 minutes of the open. Volume still weak, especially on NQ.

COB Recap

Completely off my game today. Missed all the would be target plays and only caught some scalps. Even a play around 11:30 EST that would have hit target and got me back in the green today. Took it in a paper trade with ease that quickly worked out.

Should have ended the day up more than $1,100 but best I can do at this point is take it as another learning lesson and do better next time. Having off days is just part of the game. Hoping the stars will be aligned in my favor tomorrow.

For real-time insights follow me on Twitter! @Mv3Trader

Comment below with your opinions and questions.

Rob

Mv3 Trader

“Trade Consciously”