Premarket Insight

Primary focus this week will be on GC (gold) and CL (crude oil) in the premarket and NQ after the open, staying true to my 10 min rule.

Logging in to start my day, so far GC is bouncing in a range. CL has already taken off bullish. However, need to keep in mind the volatility of CL. Typically it can always give good opportunities in any direction at any time.

I’m not seeing anything super significant on the calendar or in the news today.

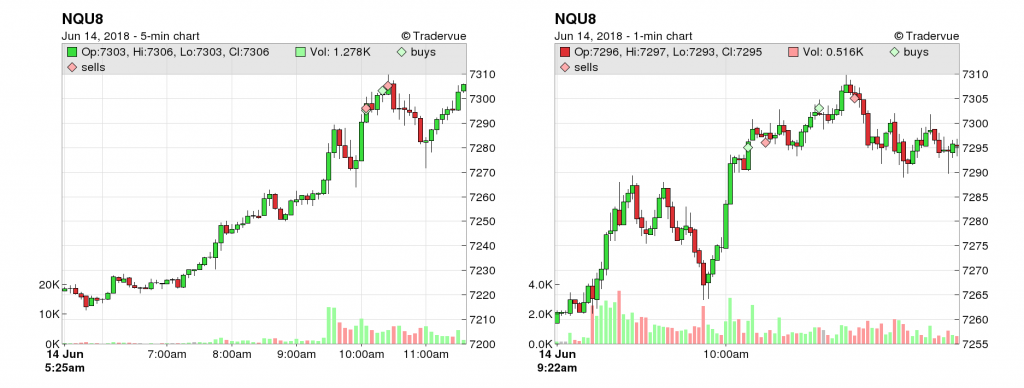

At the Bell

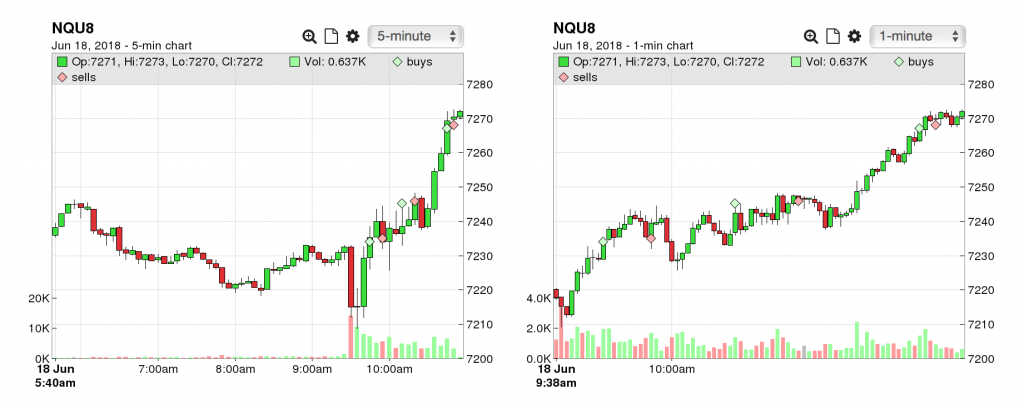

NQ had significant selloff in the premarket, down 50 points (0.70%) before the open. Most of that selloff happening before midnight Sunday. Possible flash crash coming? … (fingers crossed)

NQ continued a bearish dip and bounced off a pivotal point. (insert pun here)

COB Recap

Let the choppiness get the best of me after the open today, Only was able to catch several small scalps on NQ, but should have been much more. Started to get frustrated so decided to take a break from my desk. That’s when the market decided to have its bullish pop, where I should have got my nice win. Ended up just scalping the top of that move.

The early moves in GC and CL only resulted in a small scalp off GC in the premarket.

Comment below with your opinions and questions.

Rob

Mv3 Trader

“Trade Consciously”