Premarket Insight

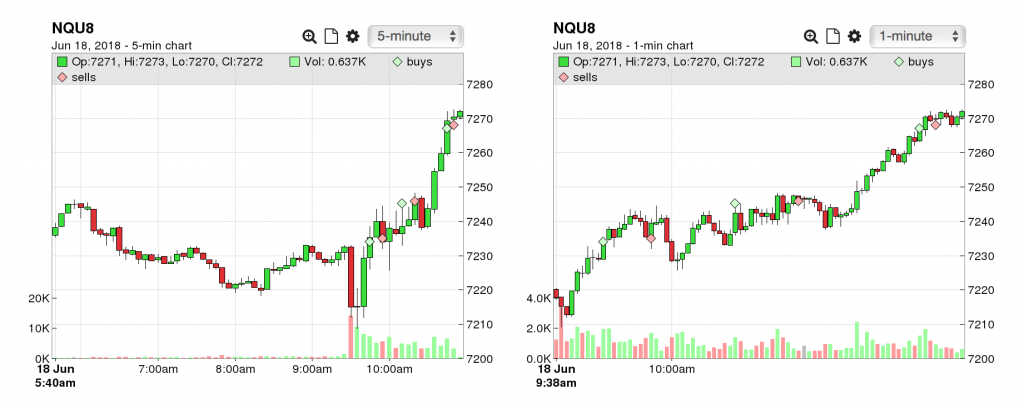

Trump does it again! Apparently, a news event based on another infamous Trump action caused the markets to take a dive after the close of Monday’s session. Imagine my disappointment when I logged into my charts first thing in the morning to see a move I’ve been waiting on for weeks to happen while I was sleeping.

At the beginning of my trading day, NQ down +75 points (1.04%), currently retesting the selloff. As expected, volume is healthy with more than 81K of volume. Nothing else super interesting on the calendar, except Building Permits as reported by investing.com. Will be interesting to see how the day unfolds.

At the Bell

Didn’t get any signals in the premarket so no trades placed. Only took a paper trade on GC with a play that will be used in the future.

As expected, NQ hung out sideways after the aftermarket selloff and popped strong bullish at the open. Staying disciplined to 10 min rule and not taking a play yet. It’s still early, there’s a good chance there will be another opportunity sometime throughout the day.

COB Recap

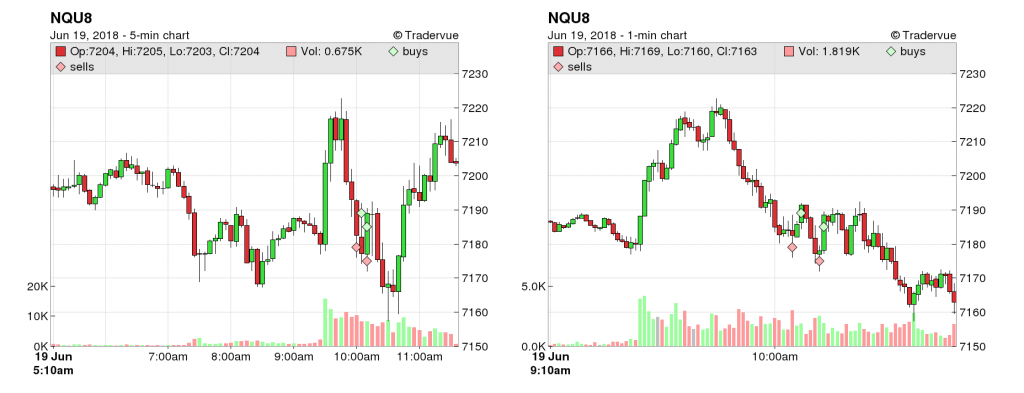

Long story short, days like this I really regret missing trades on previous days. Took a major loss today of more than 2R on my first 3 plays. Also, frustrating that if I didn’t have that 10 min rule, my strategy would have been perfect for the bullish pop at the bell. But that rule is there for a reason. Have to remember I’ve had more loses than winners in that timeframe so better to just let those potential plays be. Honestly, I should have known better than trying to go bearish so aggressively with how far the price had already dropped.

However, even with the struggles and size of this red day, still ended there was still some positives. For one, I didn’t make any mistakes in regard to how to play my strategy. If I had traded like this previous days, today wouldn’t matter much. Secondly, I did confirm that I know how to adjust for these choppy days as I was profitable paper trading with those adjustments. Go figure.

P.S. HAPPY BIRTHDAY!!! ?????

Time to go celebrate!

For real-time insights follow me on Twitter! @Mv3Trader

Comment below with your opinions and questions.

Rob

Mv3 Trader

“Trade Consciously”